Introduction

When a loved one is diagnosed with a terminal illness, it can be a challenging and emotional time. During this period, making decisions about their care is crucial to ensuring they are comfortable and supported. Hospice care is a compassionate option that focuses on providing comfort and quality of life to those with severe, life-limiting illnesses. Understanding the coverage and payment options for hospice care can help families make informed choices and alleviate some of the financial stress during this challenging time.

Overview of Hospice Care

Hospice care is specialized care designed to support patients in the final phase of a terminal illness. Its goal is not to cure the illness but to offer comfort and improve the patient’s and their family’s quality of life. Hospice care includes a variety of services, such as:

- Pain and Symptom Management: This involves ensuring the patient is as comfortable as possible by managing pain and other distressing symptoms.

- Emotional and Spiritual Support: Offering counseling and spiritual care to help patients and families cope with the emotional aspects of terminal illness.

- Medical Services: Providing medical care and oversight, often through home visits from hospice nurses and doctors.

- Respite Care: Giving family caregivers a break by arranging temporary inpatient care for the patient.

- Bereavement Support: Offering grief counseling and support to families after the patient’s passing.

Hospice care can be provided in various settings, including the patient’s home, hospice centers, nursing homes, or hospitals. The primary focus is comfort and quality of life, emphasizing a holistic approach that addresses physical, emotional, and spiritual needs.

Importance of Understanding Coverage and Payment Options

Navigating the financial aspects of hospice care can be overwhelming, but understanding coverage and payment options is essential for making informed decisions. Here’s why it’s important:

- Reducing Financial Stress: Knowing what insurance covers can help families avoid unexpected expenses and reduce the financial burden during a difficult time.

- Accessing Necessary Services: Understanding coverage ensures that patients receive all the necessary services and support without delay or denial.

- Planning Ahead: Being aware of the costs and coverage can help families plan for the future, making arrangements that align with their loved one’s wishes and needs.

- Maximizing Benefits: Different programs, such as Medicare, Medicaid, and private insurance, have various benefits. Understanding these can help families fully take advantage of available resources.

Choosing hospice care is a compassionate decision that focuses on the quality of life for those facing terminal illness. By understanding hospice care services and the various coverage options available through Medicare, Medicaid, and private insurance, families can make informed choices that honor their loved one’s needs and wishes. This knowledge helps reduce financial stress, ensures access to essential services, and allows for better planning and support during one of life’s most challenging times.

Hospice Coverage in the USA

Understanding how hospice care is covered in the United States is essential for making informed decisions about a loved one’s end-of-life care. Different programs and insurance plans provide varying levels of coverage, and it’s important to know what each one offers.

Medicare Hospice Benefit

Eligibility Criteria

To qualify for the Medicare Hospice Benefit:

- The patient must be eligible for Medicare Part A.

- A doctor and the hospice medical director must certify that the patient is terminally ill with a life expectancy of six months or less.

- The patient must choose hospice care over curative treatments.

- The patient must sign a statement choosing hospice care instead of other Medicare-covered treatments for the terminal illness.

Covered Services

Medicare covers a comprehensive range of hospice services, including:

- Doctor and nursing care

- Medical equipment (e.g., wheelchairs, hospital beds)

- Medical supplies (e.g., bandages, catheters)

- Prescription drugs for symptom control and pain relief

- Hospice aide and homemaker services

- Physical and occupational therapy

- Speech-language pathology services

- Social work services

- Dietary counseling

- Grief and loss counseling for the patient and their family

- Short-term inpatient care (for pain and symptom management)

- Respite care (temporary relief for caregivers)

Payment Structure

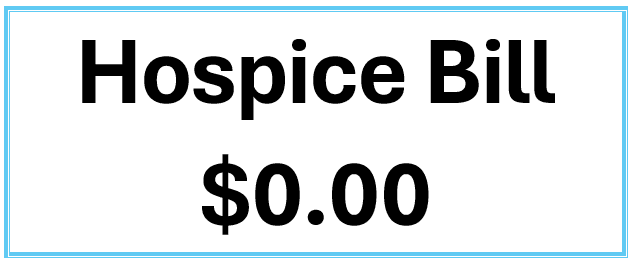

Medicare covers most hospice services at no cost to the patient. However, there may be a small copayment for outpatient drugs ($5 or less) and a 5% coinsurance for inpatient respite care.

How to Apply

- Discuss hospice care with your doctor and the hospice team.

- Choose a Medicare-approved hospice provider.

- The hospice team and your doctor will help you complete the necessary forms for hospice care.

Medicaid and Hospice Care

State Variations in Coverage

Medicaid coverage for hospice care varies by state, as each state administers its Medicaid program within federal guidelines. Some states may offer additional services or have different eligibility requirements.

Eligibility Criteria

- The patient must be eligible for Medicaid.

- A doctor must certify that the patient is terminally ill with a life expectancy of six months or less.

- The patient must choose hospice care over curative treatments.

Covered Services

Medicaid typically covers:

- Doctor and nursing care

- Medical equipment and supplies

- Medications for symptom control and pain relief

- Hospice aide and homemaker services

- Physical, occupational, and speech therapy

- Social work services

- Counseling services

- Short-term inpatient care

- Respite care

Payment Structure

Medicaid covers the full cost of hospice care for eligible patients. Depending on the state, small copayments may be required for some services.

How to Apply

- Contact your state’s Medicaid office to learn about specific requirements and services.

- Choose a Medicaid-approved hospice provider.

- The hospice team and your doctor will assist with the application process.

Private Insurance and Hospice Care

Common Coverage Policies

Most private insurance plans cover hospice care, but the extent of coverage can vary widely. Common policies include:

- Coverage for a wide range of hospice services similar to those covered by Medicare and Medicaid.

- Requirements for pre-authorization or referrals from a primary care physician.

- Limits on the number of covered hospice care days.

Variations Among Providers

Coverage details, such as which services are covered and the amount of copayment or coinsurance required, can differ significantly between insurance providers. Some plans may have higher out-of-pocket costs or restrictions on which hospice providers you can use.

How to Verify Coverage

- Contact your insurance provider to ask about your specific plan’s hospice coverage.

- Review your insurance policy documents for details on hospice care benefits.

- Consult with your hospice provider, who can often help verify insurance benefits and navigate the process.

Payment Structure

Private insurance payment structures can include:

- Full coverage of hospice care with no out-of-pocket costs.

- Copayments or coinsurance for certain services.

- Deductibles that must be met before insurance coverage begins.

Navigating Claims and Billing

- Work with your hospice provider, who typically handles billing and claims directly with your insurance company.

- Keep records of all communications and bills for reference.

- Contact your insurance company if you encounter issues or have questions about claims.

Understanding hospice coverage and payment options can significantly ease the burden during a difficult time. Medicare, Medicaid, and private insurance each offer different benefits and requirements. Knowing what each program covers and how to apply, you can ensure your loved one receives the best care without unexpected financial stress.

Additional Considerations

When planning for hospice care, it’s essential to consider potential out-of-pocket costs, services not covered by insurance, financial assistance programs, hospice care for veterans, and how to choose the best hospice provider. These factors can impact the overall care experience and financial burden on families.

Out-of-Pocket Costs

Copayments and Deductibles

Even with insurance coverage, out-of-pocket costs such as copayments and deductibles may exist.

- Copayments are small, fixed amounts you pay for certain services, such as medications or respite care. For example, Medicare may require a $5 copayment for outpatient drugs and a 5% coinsurance for inpatient respite care.

- Deductibles are the amounts you must pay out-of-pocket before your insurance begins to cover the costs. These can vary depending on your insurance plan.

Services Not Covered by Insurance

Not all services may be covered by insurance, such as:

- Experimental treatments or medications

- Certain types of therapy or counseling are not deemed medically necessary

- Private-duty nursing or personal care services beyond what is covered by the hospice plan

It is essential to review your insurance policy and speak with your hospice provider to understand what services might incur additional costs.

Financial Assistance Programs

If you are concerned about the costs of hospice care, several financial assistance programs can help:

- Nonprofit Organizations: Some organizations provide grants or financial assistance to help cover hospice-related expenses.

- State and Local Programs: Check with your state or local health department for programs offering hospice care financial assistance.

- Charitable Hospices: Some hospices offer care regardless of the ability to pay, funded by donations and community support.

Hospice Care for Veterans

VA Benefits and Hospice Care

The Department of Veterans Affairs (VA) offers comprehensive hospice care benefits for eligible veterans. This care focuses on providing comfort and support rather than curative treatments.

Eligibility and Application Process

To qualify for VA hospice benefits, a veteran must:

- Be enrolled in the VA health care system

- Have a terminal illness with a life expectancy of six months or less, as certified by a VA physician

To apply for VA hospice care:

- Contact your local VA medical center or clinic.

- Speak with a VA social worker or health care provider about your needs.

- Complete any required forms and assessments.

Choosing a Hospice Provider

Factors to Consider

Selecting the right hospice provider is crucial for ensuring quality care. Consider the following factors:

- Reputation and Reviews: Look for providers with good reputations and positive reviews from other families.

- Accreditation: Ensure the hospice is accredited by organizations like the Joint Commission or the Community Health Accreditation Partner (CHAP).

- Services Offered: Verify that the hospice offers all the needed services, such as 24/7 nursing care, spiritual support, and grief counseling.

Questions to Ask Providers

When interviewing potential hospice providers, consider asking:

- What services are included in your hospice care program?

- How often will nurses and aides visit the patient?

- How do you handle after-hours emergencies?

- What kind of support do you offer for family caregivers?

- Are your services covered by Medicare, Medicaid, or private insurance?

Understanding Quality of Care

To ensure high-quality hospice care:

- Research the provider’s history and any complaints filed against them.

- Ask about the staff’s training and experience in hospice care.

- Look for providers that offer personalized care plans tailored to the patient’s needs and preferences.

- Inquire about the hospice’s pain and symptom management approach, ensuring they prioritize comfort and quality of life.

Planning for hospice care involves understanding various aspects of coverage and payment options, including potential out-of-pocket costs, services not covered by insurance, and available financial assistance programs. For veterans, VA benefits can provide essential support. Selecting the right hospice provider is crucial, and considering factors like reputation, services, and quality of care can help ensure the best possible experience for your loved one.

Conclusion

Summary of Key Points

Understanding hospice care coverage and payment options is essential for making informed decisions during a difficult time. Here’s a quick recap of the main points:

- Hospice Coverage in the USA:

- Medicare, Medicaid, and private insurance provide different coverage levels.

- Medicare Hospice Benefit covers a wide range of services with minimal out-of-pocket costs.

- Medicaid offers comprehensive coverage with some state variations.

- Private insurance coverage varies widely, so it’s crucial to verify benefits.

- Out-of-Pocket Costs:

- Copayments and deductibles can apply even with insurance.

- Some services may not be covered by insurance, requiring additional out-of-pocket expenses.

- Financial assistance programs are available to help cover costs.

- Hospice Care for Veterans:

- The VA provides extensive hospice care benefits for eligible veterans.

- Understanding eligibility criteria and the application process is crucial for accessing these benefits.

- Choosing a Hospice Provider:

- Consider reputation, accreditation, services offered, and quality of care.

- Asking the right questions can help you select the best provider for your loved one’s needs.

Importance of Planning and Understanding Your Options

Planning and understanding your options can significantly reduce stress and ensure your loved one receives the best care. Here’s why it’s so important:

- Reduces Financial Stress: Knowing what costs to expect and what insurance covers helps avoid unexpected financial burdens.

- Ensures Comprehensive Care: Understanding coverage ensures your loved one receives all necessary services without delays or denials.

- Empowers Informed Decisions: Having detailed knowledge about hospice care options allows you to make decisions that align with your loved one’s wishes and needs.

- Provides Peace of Mind: Planning and understanding your options can bring peace of mind during a challenging time, allowing you to focus on spending quality time with your loved one.

In conclusion, learning about hospice care coverage, potential costs, and available resources can significantly improve the quality of care and support your loved one receives. It empowers you to make informed decisions, reduces financial stress, and ensures your loved one’s comfort and dignity during their final phase of life.

Resources

How Much Does Hospice Care Cost?

Medicare Hospice Care

Medicare Hospice Care Coverage

Medicaid Hospice Payments

Medicare Hospice Center

The Medicare Hospice Benefit (PDF)

The National Academy of Elder Law Attorneys (NAELA) is dedicated to improving the quality of legal services provided to older adults and people with disabilities

Articles on Advance Directives

Eldercare Locator: a nationwide service that connects older Americans and their caregivers with trustworthy local support resources

CaringInfo – Caregiver support and much more!

The Hospice Care Plan (guide) and The Hospice Care Plan (video series)

Surviving Caregiving with Dignity, Love, and Kindness

Caregivers.com | Simplifying the Search for In-Home Care

Geri-Gadgets – Washable, sensory tools that calm, focus, and connect—at any age, in any setting

Healing Through Grief and Loss: A Christian Journey of Integration and Recovery

📚 This site uses Amazon Associate links, which means I earn a small commission when you purchase books or products through these links—at no extra cost to you. These earnings help me keep this website running and free from advertisements, so I can continue providing helpful articles and resources at no charge.

💝 If you don’t see anything you need today but still want to support this work, you can buy me a cup of coffee or tea. Every bit of support helps me continue writing and sharing resources for families during difficult times. 💙

Caregiver Support Book Series

VSED Support: What Friends and Family Need to Know

My Aging Parent Needs Help!: 7-Step Guide to Caregiving with No Regrets, More Compassion, and Going from Overwhelmed to Organized [Includes Tips for Caregiver Burnout]

Take Back Your Life: A Caregiver’s Guide to Finding Freedom in the Midst of Overwhelm

The Conscious Caregiver: A Mindful Approach to Caring for Your Loved One Without Losing Yourself

Dear Caregiver, It’s Your Life Too: 71 Self-Care Tips To Manage Stress, Avoid Burnout, And Find Joy Again While Caring For A Loved One

Everything Happens for a Reason: And Other Lies I’ve Loved

The Art of Dying

Final Gifts: Understanding the Special Awareness, Needs, and Communications of the Dying

Between Life and Death: A Gospel-Centered Guide to End-of-Life Medical Care

Providing Comfort During the Last Days of Life with Barbara Karnes RN (YouTube Video)

Preparing the patient, family, and caregivers for a “Good Death.”

Velocity of Changes in Condition as an Indicator of Approaching Death (often helpful to answer how soon? or when?)

The Dying Process and the End of Life

The Last Hours of Life

Gone from My Sight: The Dying Experience

The Eleventh Hour: A Caring Guideline for the Hours to Minutes Before Death

By Your Side, A Guide for Caring for the Dying at Home

Top 30 FAQs About Hospice: Everything You Need to Know

Understanding Hospice Care: Is it Too Early to Start Hospice?

What’s the process of getting your loved one on hospice service?

Picking a hospice agency to provide hospice services

National Hospice Locator and Medicare Hospice Compare